boulder co sales tax 2020

The December 2020 total local sales tax rate was 8845. 2021 2022-2024 2024 CURRENT STATUS TABLE 2 BOULDER COUNTY CIP - 2007 Sales Tax CURRENT.

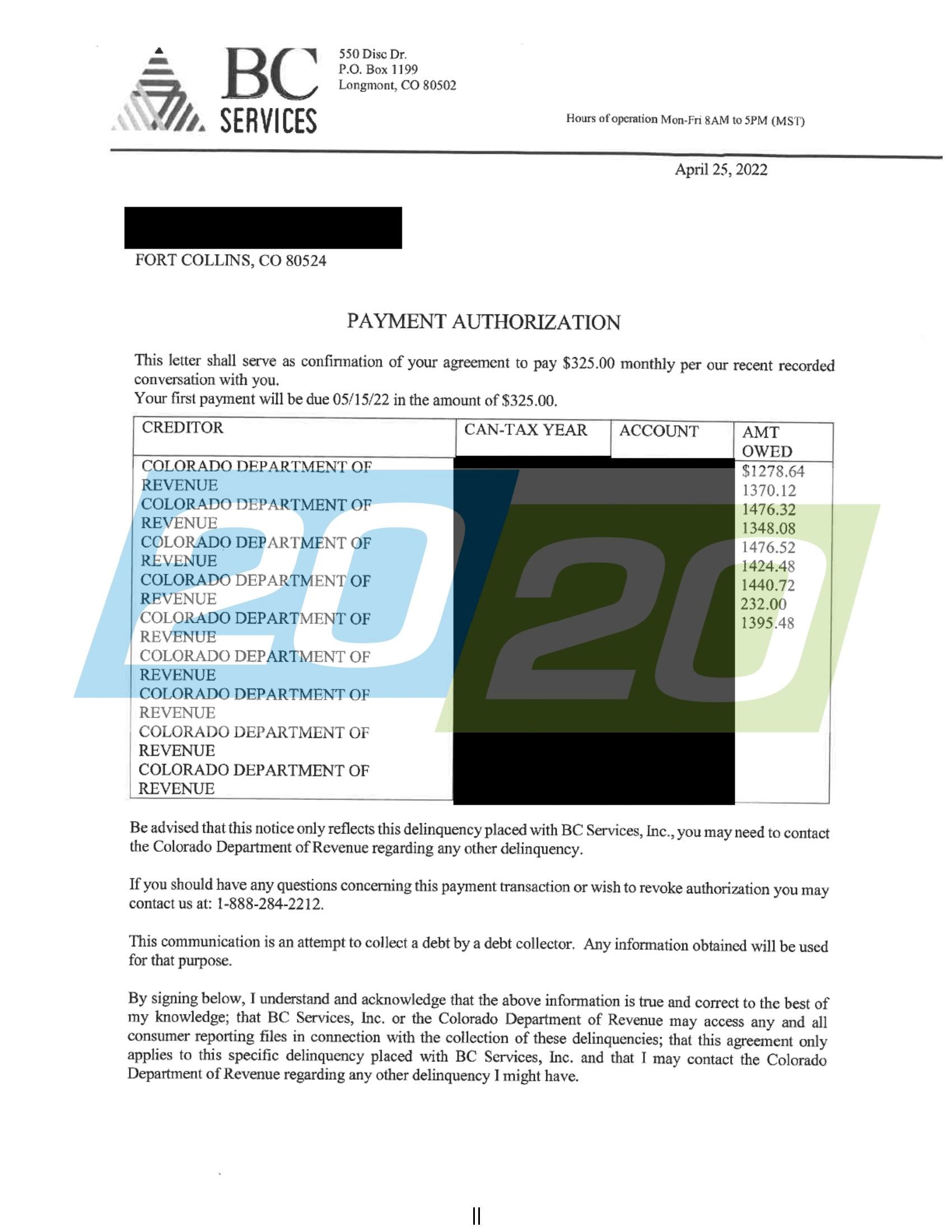

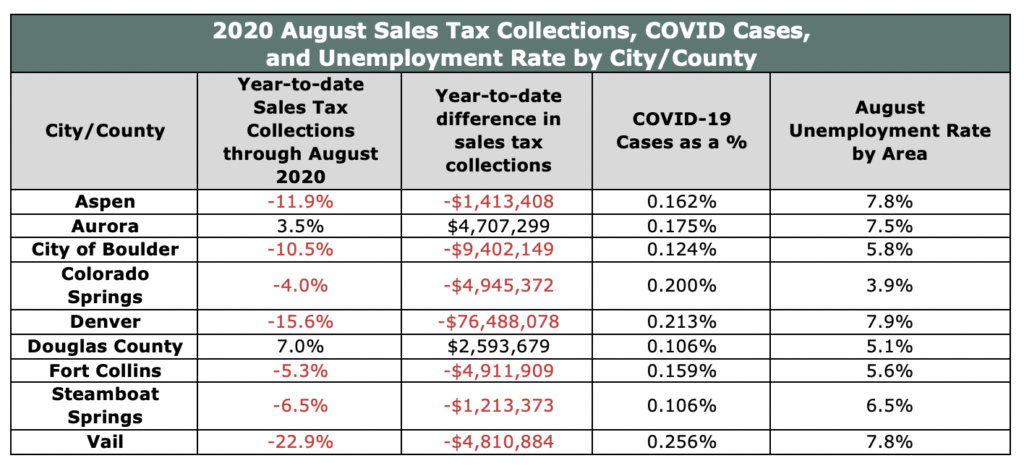

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

. Between 2009 and 2019 sales tax revenues in the city had steadily increased with the exception of a flattening between 2016 and 2017. Prior 20192020 Tax Years. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Boulder County CO Sales Tax Rate The current total local sales tax rate in Boulder County CO is 4985. Boulder County Transportation MARCH 2020 - DRAFT Page 1 of 2. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs.

The December 2020 total local sales tax rate was also 4985. The 2020 Boulder County sales and use tax rate is 0985. If you are looking for the latest and most special shopping information for City Of Boulder Sales Tax Rate 2020 results we will bring you the latest promotions along with gift information and.

The 2020 Boulder County sales and use tax rate is 0985. The COVID-19 pandemic resulted in significant. Nearby Recently Sold Homes.

The Colorado sales tax rate is currently. The City of Lovelands sales tax rate is 30 combined with Latimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. Our tax lien sale will be held Wednesday November 16 2022 Registration begins at 730 AM.

Nearby homes similar to 2020 5th pearl St Unit A have recently sold between 475K to 850K at an average of 595 per square foot. How to Apply for a Sales and Use Tax License. The 2020 Boulder County sales and use tax rate is 0985.

3 beds 2 baths 2020 sq. Boulder CO Sales Tax Rate. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Ad New State Sales Tax Registration. The Boulder County sales tax rate is 099. Mobile Home Tax Lien Sale.

The rate is comprised of individual voterapproved county sales and use tax ballot. CO Sales Tax Rate. The 2020 Boulder County sales and use tax rate is 0985.

The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans. Our tax lien sale will be held Wednesday November 16 2022 Registration begins at 730 AM Sale begins at 830 AM. 20192020 Comparable Sales 20192020 Non-Residential Sales Comparable Residential Sales Mapping Tool Base Period.

The minimum combined 2022 sales tax rate for Boulder Colorado is. Boulder Countys Sales Tax Rate is 0985 for 2020. Boulder County does not issue licenses for.

Boulder County 0985 TOTAL. Sales Tax Rates Colorado information registration support. The County sales tax.

2020 BOULDER COUNTY SALES USE TAX. The 2020 Boulder County sales and use tax rate is 0985. The current total local sales tax rate in Boulder CO is 4985.

Boulder co sales tax rate. You can print a 8845 sales tax. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and.

Because there is strong seasonality to retail sales tax revenue it is useful to compare same month-over-month revenue changes. About City of Boulders Sales and Use Tax. As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components.

December 2020 retail sales tax revenue was. SOLD MAY 13 2022. The City of Lovelands sales tax rate is 30 combined with Larimer.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. Real Property Tax Lien Sale. The ESD tax is on.

This is the total of state county and city sales tax rates.

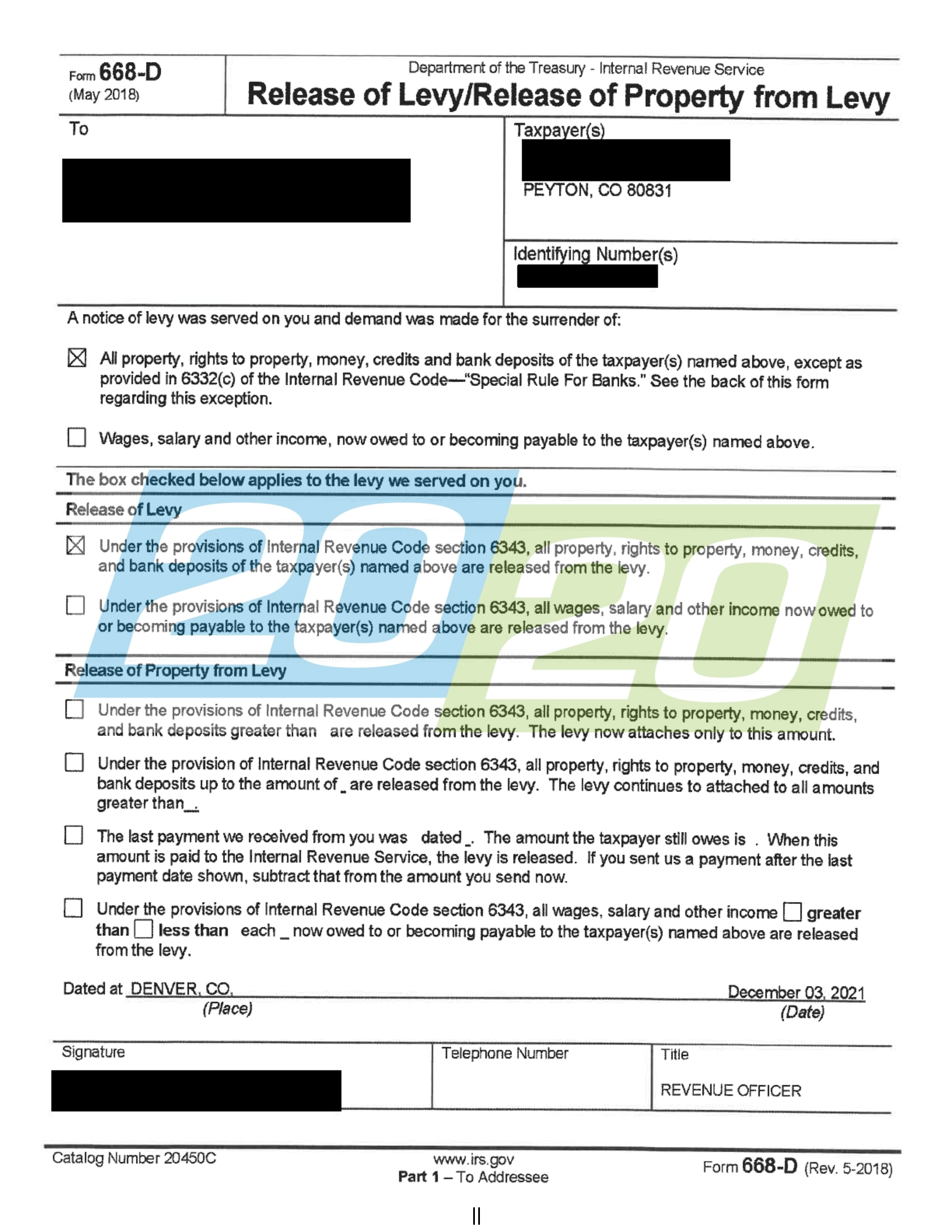

Tax Resolutions In Colorado 20 20 Tax Resolution

In California S Sonoma Valley A Modern Farmhouse With A Speakeasy Asks 16 7 Million Sonoma Valley Speakeasy Vacation Property

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado Vehicle Bill Of Sale For Purged Record Download The Free Printable Basic Bill Of Sale Blank Fo Treatment Plan Template Bill Of Sale Template Templates

/cloudfront-us-east-1.images.arcpublishing.com/gray/4OWMLEQIGNGIHJO3MBDO6A4NL4.jpg)

Call Center Set Up In Colorado For Tabor Refund Checks 55 Of Checks Mailed Out Have Been Cashed As Of Aug 17

File Sales Tax Online Department Of Revenue Taxation

Fresh Off 38m Sale Greyhound Looks To Unload Its Other Big Site In Denver Greyhound Bus Greyhound Bus Station

Sales And Use Tax City Of Boulder

Taxes In Boulder The State Of Colorado

Call Center Set Up In Colorado For Tabor Refund Checks 55 Of Checks Mailed Out Have Been Cashed As Of Aug 17

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Tax Resolutions In Colorado 20 20 Tax Resolution

Salesforce Login Salesforce Connections 2020 Salesforce Login Salesforce Is A Customer Pa Salesforce How To Motivate Employees Cloud Computing Services

In California S Sonoma Valley A Modern Farmhouse With A Speakeasy Asks 16 7 Million Sonoma Valley Speakeasy Vacation Property

5950 Encina Rd Unit 2 Goleta Ca 93117 Mls 20 3979 Zillow Kitchen Remodel Zillow The Unit

Mansion On Robinson Park Lists For 4 7m In Denver S Hilltop Neighborhood Https Dpo St 3dpcxof Modern Ranch Mansions Indoor Outdoor Living

5950 Encina Rd Unit 2 Goleta Ca 93117 Mls 20 3979 Zillow Kitchen Remodel Zillow The Unit

5950 Encina Rd Unit 2 Goleta Ca 93117 Mls 20 3979 Zillow Kitchen Remodel Zillow The Unit